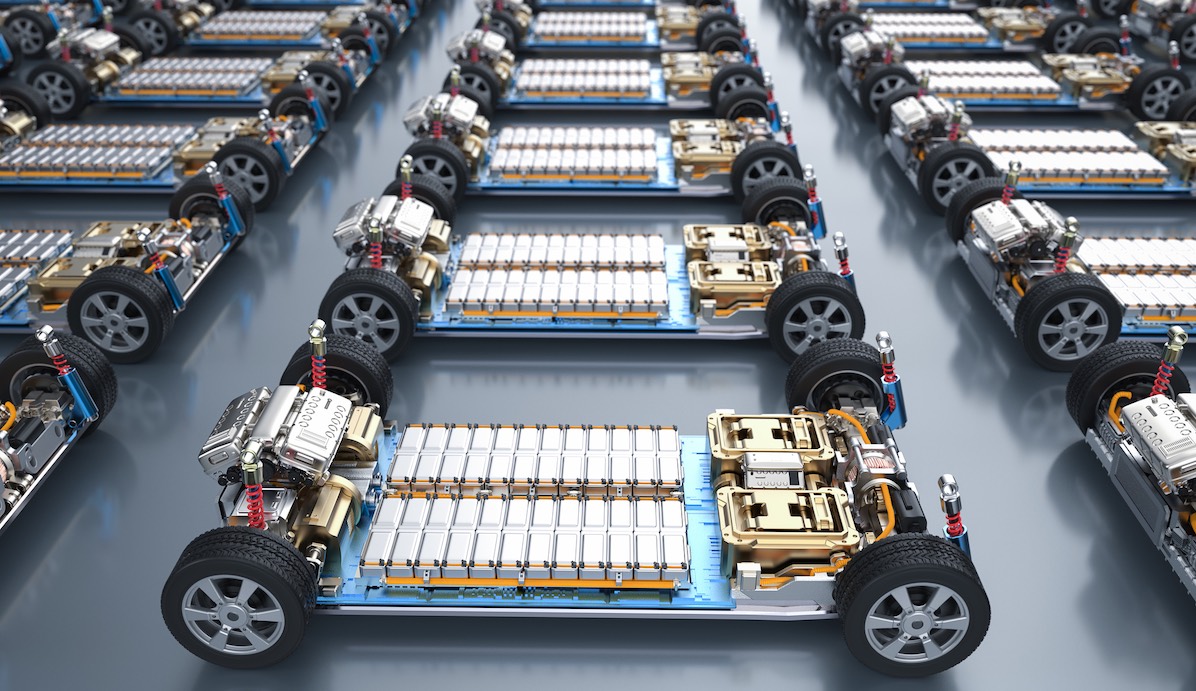

Government-industry strategic collaboration is key to making Canada a global leader in battery technology

Mark LoweyAugust 21, 2024

Canada needs a strategic collaboration by government and industry to become a global leader in clean, innovative battery technology and a North American hub for sustainable battery production, says a report by Accelerate.

Canada needs a strategic collaboration by government and industry to become a global leader in clean, innovative battery technology and a North American hub for sustainable battery production, says a report by Accelerate.

While Canada is a leader in early-stage innovation in battery technology – in part due to strong government expenditure on R&D – innovators often fail to scale at home, according to the “roadmap” report. “Too often, they are bought by foreign firms, or they stall along the commercialization pathway.”

“Canada simply cannot be competitive without a strategic approach,” says the Canadian Battery Innovation Roadmap, which outlines a strategy to establish Canada as a global leader in battery technology by 2035.

Accelerate is Canada’s ZEV (zero-emission vehicle) industry alliance. The report’s authors are: Moe Kabbara, vice-president; Bentley Allan, transition pathway principal; and Travis Southin, future economy lead. They are all with the Transition Accelerator, a pan-Canadian organization that works with others to identify and advance viable net-zero pathways for Canada.

The report was funded by Natural Resources Canada and the Ivey Foundation. It includes an interactive online roadmap, designed to help navigate key battery innovation policies.

There is a global competitive race to create innovative technologies that will shape this future, the report says.

Global battery demand by end-use application is forecasted to increase to more than 5,000 gigawatt-hours by 2035, from just over 1,000 GWh in 2024.

China, the U.S., the European Union and Japan have secured technological leadership through “networked industrial policy” to align public and private investments in value-added niches in global supply chains by scaling of the technological capabilities of domestic firms, according to the report.

Networked industrial policy takes a technology-specific, targeted approach to catalyzing and de-risking collaboration among a cohort of innovative battery firms over time.

This strategy mobilizes a broad policy mix, including supply-side inputs to innovation (such as R&D support and infrastructure, skilled labour, upstream materials) and demand-side market pull for innovative products (such as procurement, consumer incentives, regulations).

Canada was an early mover in lithium-ion battery innovation, the report notes.

Burnaby, B.C.-based Moli Energy was a leading lithium-ion battery maker in the 1980s, spearheading the charge to commercialize the lithium-ion battery. Moli was the first manufacturer of lithium-ion batteries in North America.

But Canada lost its critical edge because it failed to see the economic, geopolitical, and environmental value of this technology at the right moment, the report says.

After a Moli-made battery cell caught fire, the B.C. government called in a loan and forced Moli’s sale to a Japanese consortium for $5 million. The company had assets worth $58 million and had received $120 million in government support.

The report also presents the “cautionary tale” of the lithium-iron-phosphate (LFP) battery invented at the University of Texas, Austin by John Goodenough.

The battery suffered from low conductivity until a Québec-based consortium led by Michael Armand developed a special coating procedure. The consortium, which included the Université de Montreal and Hydro Québec, then held the intellectual property that was critical to commercializing LFP technology.

In a “major industrial policy failure,” Hydro Québec allowed its patent to be used in China without licensing fees so long as the batteries were not sold outside of China.

Chinese industrial policy then supported the development of LFP at Contemporary Amperex Technology Limited (CATL), which is now the world’s largest battery producer. CATL now makes the world’s cheapest batteries and LFP comprises 40 percent of the domestic market in China.

The Québec-based consortium’s patent expired in 2022. CATL is now free to export its technology and production capabilities around the world. What happened to the LFP battery “constitutes a major failure of industrial policy in retrospect.”

Canada has considerable strength and depth in batteries research

Despite such setbacks, “Canada’s legacy of battery innovation persists,” the report says. Canada recently achieved a significant milestone by topping BloombergNEF’s global lithium-ion battery supply chain ranking, surpassing major players like China.

This ranking, the report says, reflects the country’s robust manufacturing capabilities, strong environmental and social governance credentials, and substantial investments from industry giants such as Umicore, Volkswagen, Ford, Stellantis, and LG Energy Solutions.

Canada’s homegrown battery sector includes companies, to name a few, such as Nano One, Electrovaya, Novonix, Lion Electric, and Li-Cycle that have secured substantial funding to drive their innovative projects.

Canada also has major battery research centres, including:

- Canadian Battery Innovation Centre (CBIC): Located at Dalhousie University, the CBIC is set to open in fall 2025. It will be the first university-based battery prototyping and testing facility in Canada, providing open access to researchers and industry partners.

- Western Canada Battery Consortium (WCBC) and Battery Innovation Hub: The University of Calgary hosts the WCBC which focuses on developing advanced battery technologies with higher energy density, faster charging times, and improved safety.

- Waterloo Institute for Nanotechnology (WIN): Located at the University of Waterloo, WIN conducts cutting-edge research in nanotechnology, including advancements in battery technology.

- National Research Council of Canada (NRC): The NRC’s Advanced Clean Energy program includes a focus on battery energy storage. NRC facilities across Canada, including in Vancouver, Ottawa, Boucherville, Que., and Edmonton, offer capabilities in battery performance and safety evaluation, pilot-scale battery manufacturing and materials synthesis.

- Ontario Battery and Electrochemistry Research Centre (OBEC): Located at the University of Waterloo, OBEC is a hub for electrochemical energy storage research. OBEC collaborates with industry and government agencies to develop cleaner and more efficient energy technologies for various applications, including portable electronics, electric vehicles, and smart grid systems.

- University of British Columbia - Next Generation Battery Research and Training Centre: UBC Okanagan is home to this centre, which focuses on training and research in advanced battery technologies, aiming to develop innovative solutions for energy storage challenges.

- Hydro-Québec’s Center of Excellence in Transportation Electrification and Energy Storage: This center focuses on developing solid-state batteries, advanced battery materials, and energy storage systems for transportation and grid applications.

Despite considerable research strengths, the report points out that Canada’s existing suite of innovation programs do not take a targeted approach to focusing on battery innovation.

Instead, programs like the Strategic Innovation Fund’s Net-Zero Accelerator, Canada Growth Fund, and Sustainable Technology Development Canada focus more generally on net-zero technologies and cleantech.

Moreover, battery-specific R&D programs such as the NRC Office of Energy Research and Development’s Charging the Future and the Energy Innovation Program’s Battery Industry Acceleration Call are impermanent and smaller scale than larger funds.

Canada has made a huge bet on batteries with strategic investments in up to 195 GWh of battery production across three major facilities, the report says.

The federal government’s “Mines to Mobility” initiative, launched in 2019 to establish a passenger EV battery value chain in Canada, has in collaboration with the provinces and territories, catalyzed more than $46 billion in announced investments as of mid-2024.

But these investments in assembly could result only in a thin industry: high-value components and intellectual property from other countries is simply assembled in Canada, the report warns.

“The task now is to maximize the value of these factories by building the production networks around them into an innovative ecosystem that increases efficiency and advances the core technology.”

Addressing the battery ecosystem’s three main problems

Canada’s battery ecosystem still suffers from three main problems that require industrial policy solutions, according to the report.

First, Canada has produced key battery technologies and innovative firms, but these firms do not scale up into strong, scaled homegrown firms.

Second, innovative firms struggle to secure the financial capital they need to survive and expand through the pipeline from discovery to commercialization.

Third, firms that do thrive often leave, or manufacture their products elsewhere.

The report says the first element of a strategic approach is to set the right targets and metrics, by focusing on market, environmental, and geopolitical drivers.

Market drivers include improving energy density to increase range, reducing charging time, enhancing cold-weather performance, extending cycle life, lowering costs and ensuring safety.

These factors are crucial for the widespread adoption of battery technologies across various applications, from electric vehicles to grid-scale energy storage.

Environmental drivers emphasize the need for sustainable materials, efficient recycling processes, low-emissions production methods, and second-life applications for batteries.

“By prioritizing these factors, Canada can position itself as a leader in sustainable battery technology, aligning with global efforts to combat climate change and reduce environmental impacts.”

Geopolitical drivers focus on reducing dependency on critical materials like cobalt, ensuring ethical sourcing practices and building resilient supply chains.

The report sets out actions and goals in two main themes: innovation infrastructure and industrial policy.

In innovation infrastructure, the actions needed in the financial ecosystem are to enhance funding mechanisms and align existing programs to support battery innovation across all stages of development.

“Establishing a financial working group is essential to address the persistent challenges that innovative battery firms in Canada face in scaling their operations due to limited access to private capital.”

The report also recommends creating a dedicated Battery Innovation Venture Fund through a public-private partnership where government funding provides initial seed funding to encourage private investment from Canadian venture capital firms.

Canada’s Scientific Research and Experimental Development tax credit program should include specific incentives for batteries, the report says.

It recommends implementing R&D minimums for public support to ensure that companies receiving government assistance contribute to Canada’s innovation ecosystem.

Also, the NRC Office of Energy Research and Development’s funding program should be expanded to offer larger grants – up to $50 million per project – for growth-stage battery technology companies.

Funding agencies, such as Business Development Canada, the Canada Innovation Corporation, and the Canada Growth Fund, should have dedicated battery specialists to map the entire battery innovation ecosystem and make targeted interventions, ensuring alignment and connectivity across firms, government agencies and research labs, the report says.

“Focusing on filling gaps in seed funding, demonstration funding in the tens of millions [of dollars], and scaling up funding of Canadian innovation in the hundreds of millions is essential.”

The goal is for $3 billion to be invested in battery innovation through public and private funding, including: $500 million for advanced manufacturing; $1 billion for emerging technologies; and $1.5 billion for demonstrations and pre-commercialization projects.

Building physical assets, skills and talent

In physical assets, the actions needed include expanding existing research centres (including building battery recycling centres alongside existing research hubs), launching three new battery research centres across Canada, establishing state-of-the-art demonstration facilities for testing large-scale battery technologies, and building out national labs to support cutting-edge battery research and development.

The report proposes the creation of regional production clusters that bring together R&D centers, firms, and other stakeholders to foster collaboration and knowledge sharing along the entire battery value chain.

The goal is that Canada’s battery R&D centres and national labs contribute significantly to achieving the innovation metrics laid out in the roadmap.

In skills and talent, the actions needed include developing specialized training programs, enhancing partnerships with educational institutions, and creating a skilled workforce to drive battery innovation.

The report proposes developing international partnerships with leading organizations focused on battery training, enhancing collaboration between universities, technical schools, and battery companies to co-create relevant curricula, and launching specialized training programs and apprenticeships.

Additionally, the report recommends creating a fellowship program to support advanced research in battery technologies, ensuring a pipeline of high-level expertise to drive innovation.

The goal is by 2035, train and integrate more than 10,000 skilled professionals into Canada’s battery industry, with at least 500 graduates annually from specialized training programs.

Targeted policies and programs to help firms scale up

In the other main theme, industrial policy, actions needed in scale-up support are to implement targeted policies and programs to help innovative firms grow and remain in Canada, capturing more value within our domestic economy.

The report recommends establishing a National Battery Alliance, a central coordinating body that will drive the roadmap’s implementation and foster collaboration across the ecosystem. Such bodies exist in the EU (European Battery Alliance) and in the U.S. (Li-Bridge).

This alliance will bring together key stakeholders from government, industry, and academia to align efforts, share information and develop strategies to overcome challenges in the battery innovation landscape.

To complement the alliance, the report proposes creating a dedicated, agile, cross-departmental government problem-solving team to address specific issues and opportunities in the battery sector.

Other key initiatives are: develop of a Battery Ecosystem Intelligence Dashboard to track progress, analyze the current state of the ecosystem, and inform decision-making; and launch a national Battery Technology Incubator Program to seed and support numerous startups in the battery sector.

The report also emphasizes the need to streamline regulatory processes for new battery technologies, reducing barriers to innovation and commercialization.

The goal is by 2035, increase the number of Canadian-owned firms in the battery sector tenfold, contributing to 20 percent of the North American battery value chain.

In IP strategy, the actions needed are to strengthen intellectual property protection and development strategies to ensure Canadian innovations benefit our economy and global competitiveness.

To accelerate innovation in key areas, the report suggests implementing a fast-track patent processing system for technologies deemed critical to national interests, and programs for sharing and pooling non-core patents among Canadian battery companies.

The goal is to secure 1,000 patents in battery technology by 2035.

The report points out that it’s important to distinguish between invention – creating a truly new thing – and innovation, which is the process of using ideas to improve products and services.

Building an innovation economy “cannot be equated with chasing investment or building a startup culture,” the report says. “Knowledge creation should be integrated with manufacturing and upstream commodity supply chains into a dynamic system of R&D, commercialization, and production. This is an innovation ecosystem.”

The goal is to create places where innovators with diverse ideas can engage in meaningful exchange. These places must have strong connections to the global community so that they can play strategic roles in global production networks. The provision of public goods, physical and financial assets is critical to the development of these ecosystems.

The report says the immediate priority is to establish the National Battery Alliance, the central coordinating body. The alliance would develop a detailed implementation plan for the roadmap, initiate the Battery Ecosystem Intelligence Dashboard, launch working groups on critical issues, and begin outreach to international partners.

“This alliance will unite key players from government, industry, and academia to drive the realization of our vision.”

[Editor’s note: The Transition Accelerator released a separate report in August 2022 on building a homegrown battery metals supply chain for electric vehicles, by focusing on the midstream segment of the supply chain].

R$

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 1 free article remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.