GOVERNMENT FUNDING

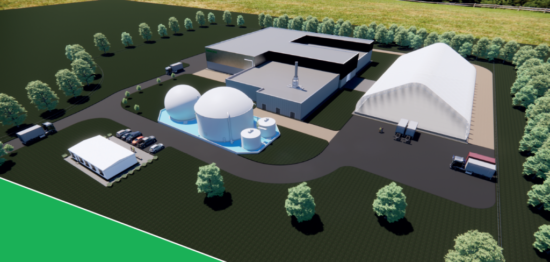

The Government of Canada and the Government of Quebec announced more than $26 million in joint financial assistance to support Saint-Ėtienne-des-Grès, Que.-based Énercycle, the Régie de gestion des matières résiduelles de la Mauricie, for its project to develop a new organic waste recovery centre (illustration at right) using biomethanization and composting. The federal government is investing nearly $14.7 million from the Green Infrastructure stream of the Investing in Canada Infrastructure Program. Quebec’s financial assistance, totalling more than $11.7 million, is granted under Stream 1 of the Programme de traitement des matières organiques par biométhanisation et compostage. The project, in addition to diverting approximately 35,000 tonnes of organic matter from disposal per year, will reduce greenhouse gas emissions by 3,286 tonnes of CO2 equivalent per year. These investments will support the construction and operation of Énercycle’s new biomethanization and composting facilities, which will be built on the landfill in Saint-Étienne-des-Grès. The funds will be used to construct buildings, develop composting treatment areas, install a digester and other related equipment. The new Énercycle organic waste recovery centre will serve a significant portion of the population in the Mauricie region, including the urban agglomerations of Trois-Rivières and Shawinigan, as well as the regional county municipalities of Mékinac, Maskinongé and Des Chenaux. The project will also make it possible to collect organic waste from industrial, commercial and institutional sources in the region. The project, with an estimated total cost of over $75.7 million, also includes a connection to the biogas treatment and purification system, which will enable biomethane to be injected into the gas network. A wastewater treatment plant will also be installed. The facility, which is scheduled for commissioning in autumn 2026, will eventually produce over 1.2 million cubic metres of biomethane for injection into the Énergir network. Housing, Infrastructure and Communities Canada

The Natural Sciences and Engineering Research Council of Canada (NSERC) announced a $87.5-million federal government investment over four years to support 16 collaborative research projects involving 165 researchers from 30 different academic institutions across Canada, that will contribute to a sustainable, profitable and resilient agriculture and agri-food sector. The research teams and projects are supported by grants awarded through the NSERC-SSHRC Sustainable Agriculture Research Initiative, a joint initiative between the Natural NSERC and the Social Sciences and Humanities Research Council, in collaboration with Agriculture and Agri-Food Canada. These projects, incorporating researchers and partners from across Atlantic Canada and beyond, aim to develop and apply state-of-the-art climate mitigation approaches to increase farm profitability while lowering environmental risks. The projects encompass: precision agriculture technologies, sustainable agriculture; the Canadian Soil Data Portal; a Canadian Nitrous Oxide Collaborator Network; reducing insecticide use; adopting genomic tools; food security; net-zero farming systems; net-zero carbon emission technology for greenhouses; perennial plant restoration; and more. NSERC

Housing, Infrastructure and Communities Canada (HICC) announced a federal contribution, through the Green and Inclusive Buildings Program, of more than $24 million to build a new net-zero community centre in Mary’s Harbour, Labrador. The new 10,000-plus square foot building will include a reception area, a NunatuKavut tourism visitor information centre, a cultural space with interpretive displays on the history and culture of the NunatuKavut Inuit of southern and central Labrador, as well as office space and a renewable energy learning centre. The centre will also include community meeting rooms. The facility will be primarily solar-powered, and will have an inclusive design to allow accessibility and use for everyone. HICC

The Government of Canada and the Government of Ontario are investing up to $22.6 million, through the Sustainable Canadian Agricultural Partnership, to expand production capacity and boost energy efficiency in the agriculture and food sector. The Agri-Tech Innovation Initiative is supporting 319 farming and agri-food businesses to help them invest in innovative technology, equipment or processes that will expand production capacity or enhance efficiency. This government support, combined with cost-shared investments by the sector, is expected to generate up to $61 million in production investment improvements in the industry. Some examples of investments made through this initiative include:

- Up to $49,000, for Roelofsen Nursery, in Norwich, to purchase an electric self-propelled sprayer for field nursery crops.

- Up to $45,000 for Byler Enterprises Ltd., in Algoma District, to install reverse osmosis equipment for maple syrup production that concentrates sap, reducing boiling time and required energy, while improving syrup quality.

- Up to $100,000, for Solmaz Foods, in Etobicoke, for a refrigeration and freezer investment to enhance energy efficiency and capacity.

This investment supports the Grow Ontario Strategy's objectives of increasing production and consumption of food grown and prepared in the province by 30 percent by 2032 and boosting the economic impact of Ontario's food and beverage manufacturing sector by 10 percent. Agriculture and Agri-Food Canada

Environment and Climate Change Canada (ECCC) announced more than $11.7 million for biosphere regions across Canada. This funding will support projects led by the Canadian Biosphere Regions Association and the network of 19 biosphere regions across the country located in areas with high conservation value and potential. The funding will also help communities thrive in harmony with nature. This is in addition to $11.3 million in funding that the biosphere regions have received since 2021. The recipients and their approved funding are:

Alberta

Waterton Biosphere Reserve Association – $463,140

Beaver Hills Biosphere Reserve Association – $602,640

British Columbia

Vancouver Island University’s Mount Arrowsmith Biosphere Region Research Institute – $623,740

Clayoquot Biosphere Trust Society – $845,140

Howe Sound Biosphere Region Initiative Society – $641,158

Manitoba

Riding Mountain Biosphere Reserve Inc. – $463,140

New Brunswick

Fundy Biosphere Initiative Inc. – $963,040

Northwest Territories

Délı̨nę Got’ı̨nę Government – $463,140

Nova Scotia

Southwest Nova Biosphere Reserve Association – $612,640

Bras d’Or Lake Biosphere Region Association – $463,140

Ontario

Long Point World Biosphere Reserve Foundation – $538,000

Georgian Bay Biosphere Inc. – $936,890

Plenty Canada – $562,140

Frontenac Arch Biosphere Network – $562,662

Quebec

Comité de la zone d’intervention prioritaire du lac Saint-Pierre – $463,140

Réserve mondiale de la biosphère Manicouagan-Uapishka – $463,140

Corporation de la réserve de la biosphère de Charlevoix – $463,140

Centre de conservation de la nature Mont Saint-Hilaire (Connexion Nature) – $690,140

Saskatchewan

Redberry Lake Biosphere Region – $463,140

National

Canadian Biosphere Regions Association – $525,000 ECCC

Innovation, Science and Economic Development (ISED) announced the organizations selected to operate the 2SLGBTQI+ Entrepreneurship Program’s Knowledge Hub and to deliver the program’s Ecosystem Fund. The $8 million Ecosystem Fund supports non-profit ecosystem organizations serving 2SLGBTQI+ entrepreneurs. The fund will help recipient organizations offer programs and resources to support these entrepreneurs, raise awareness of the challenges they face to improve support and services, and cultivate a more cohesive network of 2SLGBTQI+ entrepreneurs and ecosystem organizations. Canada’s 2SLGBTQI+ Chamber of Commerce has selected the first 17 organizations to deliver the Ecosystem Fund across Canada:

- 2 Spirits in Motion Society (national).

- Access Alliance Multicultural Health and Community Services, in partnership with UPlift Black (Ontario).

- Alberta LGBTQ+ Chamber of Commerce (Alberta).

- Banff Pride Society, in partnership with Bow Valley Chamber of Commerce (Alberta).

- Chroma NB, in partnership with Envision Saint John and Fusion Saint John (New Brunswick).

- Comité FrancoQueer de l’Ouest, in partnership with Société de développement économique de la Colombie-Britannique, Parallèle Alberta, Chambre de commerce LGBT du Québec, and Les Chevronné.e.s. (Western Canada).

- Community Futures British Columbia, in partnership with myCEO (British Columbia).

- Evol, in partnership with Fondation Émergence (Quebec).

- FrancoQueer, in partnership with Impact ON, and Fédération des aînés et des retraités francophones de l’Ontario (Ontario).

- Les Chevronné.e.s (Quebec).

- Pictou County Partnership, in partnership with Pictou County Pride (Nova Scotia).

- QueerTech (national).

- SASKQUEER Entrepreneurs + Professionals (Saskatchewan).

- Social Entrepreneurship Enclave (Manitoba).

- Sovereign Seeds (national).

- Spindle Films Foundation (national).

- The Old School House Arts Centre, in partnership with Creative Coast BC, 4VI, and the Aunty Collective (British Columbia).

The organization selected to operate the Knowledge Hub is the Fyrefly Institute for Gender and Sexual Diversity, in partnership with the eHUB Entrepreneurship Centre, at the University of Alberta. The Fyrefly Institute will receive $3 million to build a national research network focused on collecting data to create a clearer picture of the entrepreneurship landscape for the 2SLGBTQI+ community, and on developing best practices and tools to benefit 2SLGBTQI+ entrepreneurs. 2SLGBTQI+ entrepreneurs are a core part of Canada’s economy, with over 100,000 2SLGBTQI+-owned and -operated businesses in Canada employing over 435,000 Canadians and generating over $22 billion in economic activity. Yet these entrepreneurs continue to face systemic barriers in starting and growing their businesses. To address these challenges and build a more inclusive economy, the federal government created Canada’s first-ever 2SLGBTQI+ Entrepreneurship Program. ISED

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario) is investing $4.5-million in the First Nations Technology Institute (FNTI), an Indigenous-owned and governed educational institution located on Tyendinaga Mohawk Territory near Belleville, Ont. Helicopter pilots play a critical role in providing services to Indigenous communities in remote regions where traditional infrastructure is limited. This funding will support the expansion of FNTI’s aviation programming options by establishing a new helicopter training program. The program will offer students the opportunity to train with advanced equipment and experts, and to obtain their helicopter pilot licence with a specialized focus on servicing the unique needs of remote Indigenous communities. FedDev Ontario

The Federal Economic Development Agency for Southern Ontario (FedDev Ontario) announced a repayable investment of more than $7.7 million for six southwestern Ontario manufacturers. The recipients are:

- Edge Automation Inc., London (just over $1.18 million) – to establish a first-of-its-kind woodworking robotics manufacturing facility to help meet the growing demand for automated solutions in the sector.

- MTO Metal Products Ltd., Woodstock (about $1.08 million) – to increase its manufacturing capabilities with the adoption of advanced manufacturing equipment, and be able to meet the growing demands for electrification from its clients.

- New-Form Tools Ltd., Stratford ($1.55 million) – to increase manufacturing capabilities and develop its own structural components of a saw blade in-house. This will increase its made-in-Canada saw blade manufacturing for the woodworking industry and new markets.

- Roden Manufacturing, Comber (nearly $1.26 million) – to add state-of-the-art equipment to increase and modernize its manufactured parts capabilities, to take on larger contracts and diversify its automotive customer base.

- Tradeline Products Inc., London ($1 million) – to expand its manufacturing capabilities to address the needs of customers in the automotive and heavy equipment sectors.

- UE Enclosures, Leamington ($1.7 million) – to help modernize its operations through the addition of new manufacturing equipment for the company's 35,000-square-foot facility expansion. This will help meet client demand for its custom enclosures, increase its made-in-Canada production and support local supply chains in Leamington and surrounding areas. FedDev Ontario

The Public Health Agency of Canada (PHAC) announced more than $6.6 million in federal funding for seven Canadian organizations, through the Enhanced Surveillance for Chronic Disease Program, to support projects that address persistent public health evidence gaps and the development of a robust evidence base on chronic diseases and conditions, injury, mental health, substance use and their risk factors. The recipient organizations and their projects are:

- British Columbia Centre for Disease Control ($976,431) – Multi-provincial Surveillance Systems for Post-COVID-19 Condition and Outcomes.

- Canadian Centre on Substance Use and Addiction ($975,822) – Using Artificial Intelligence and Internet Technologies to Enhance Real-time Surveillance of Substance-related Harms.

- First Nations Health Authority ($976,827) – Mental Health & Wellness Among First Nations in BC: A comprehensive review of indicators for mental health.

- Inner City Health Associates ($976,827) – Enhanced Community Assessment and Risk Evaluation Program (CARE 2.0).

- St. Paul’s Foundation of Vancouver ($975,380) – Creating a comprehensive surveillance system to optimize youth mental health and substance use outcomes.

- University of Toronto ($973,792) – Pan-Canadian Perinatal Opioid Use Surveillance System.

- University of Waterloo ($766,396) – Enhanced Mental Health Surveillance in Community Care and Long-Term Care Settings. PHAC

Prairies Economic Development Canada (PrairiesCan) announced a federal investment of over $6.3 million for nine projects to help Saskatchewan businesses access the tools and resources needed to start up, scale up and bring innovative products and services to new markets. Non-repayable investments in the ecosystems supporting new businesses in Saskatchewan will help startups, including Indigenous businesses, navigate the first steps in establishing and growing their business. Repayable investments in high-growth businesses will help them scale-up and expand with new services, products and market reach, aiding in their future success and creating more good jobs. Examples of projects receiving support include:

- Andgo Systems Inc. is receiving over $2 million to scale up operations and sales of their workforce management software platform.

- Saskarc Inc. is receiving over $1.1 million to purchase automated processing equipment to increase its structural stick steel fabrication capacity. Structural stick steel is used in large infrastructure projects like airports, bridges, and high-rise buildings.

- Indigenous Manufacturing and Contracting Network Inc. is receiving $160,000 to provide training and mentorship opportunities for Indigenous companies in the manufacturing and contracting sectors. PrairiesCan

Housing, Infrastructure and Communities Canada (HICC) announced a combined investment of nearly $6 million from the Government of Canada and the City of Sarnia for Sarnia Transit to buy three zero-emission buses and install three new charging stations. The federal government is investing $4.88 million through the Rural Transit Solutions Fund, and the City of Sarnia is contributing $1.22 million. These investments will allow Sarnia Transit to expand its fixed-route and on-demand services to better serve all areas of the city, including rural areas with limited service. This expansion will also allow Sarnia Transit’s Care-A-Van service to better serve seniors and people with special needs, helping them get around their community. HICC

Natural Resources Canada (NRCan) announced a federal contribution of more than $2.8 million to Pointe-Claire, Que.-headquartered FPInnovations, a private not-for-profit organization focused on Canada’s forest sector and its affiliated industries, for three projects. The funding includes investments to support the use of low-carbon Canadian wood in the domestic construction market and a project to support the use of zero-emissions vehicles in the forestry and commercial transportation sectors. These investments are provided through NRCan’s Green Construction through Wood program and its Zero Emission Vehicle Awareness Initiative. To support the expansion of low-carbon construction materials, NRCan is providing more than $2.5 million to FPInnovations to collect and analyze market data and develop market intelligence with several collaborators in provinces across Canada. This will involve research and testing activities to enable the commercialization of various wood building systems and to generate the necessary data to enable these wood-based systems to be adopted in Canadian building codes. NRCan also is providing more than $212,000 to FPInnovations to develop resources to support the use of vehicles that are zero-emission or use clean fuels through demonstrations, short operational trials and highlights – helping to reduce emissions and enhance the modernization of the Canadian forestry and commercial transportation sectors. NRCan

Canada Economic Development for Quebec Regions (CED) is providing more than $1.67 million to Emballages Façoteck to improve the company’s productivity and production capacity. The company, located in Scotstown, Que., specializes in manufacturing and packaging natural health, pharmaceutical and cosmetic products carrying private labels. The project involves purchasing and installing an automated encapsulating machine, a metal detector for quality control and commercial vacuums. The Government of Canada is providing a repayable contribution of $175,000 for this project through CED’s Regional Economic Growth through Innovation program. The Government of Quebec is granting two loans totalling up to $688,000 under the ESSOR Program. Two additional loans totalling $812,000 are being allocated to the business by Investissement Québec, through the Productivity Innovation initiative. CED

Canada Economic Development for Quebec Regions (CED) announced repayable contributions totalling $1.15 million for five Montreal businesses. The recipients are:

- MY01 ($450,000) – to implement an international marketing strategy for a medical device designed by MY01 to continuously monitor pressure in muscles at risk of developing compartment syndrome.

- Stathera ($300,000) – to purchase test equipment to accelerate the commercialization of products developed by Stathera, a business specializing in deep semi-conductor technology.

- InfinityQ Technology Inc. ($200,000) – to implement an international marketing strategy for the quantum-inspired technological solutions developed by InfinityQ for the transportation and logistics sector.

- Sinistar Inc. ($100,000) – to market Sinistar internationally. Sinistar is a temporary housing rental platform for the relocation of insured individuals in cases of disaster.

- Solutions Beeye Inc. ($100,000) – to market internationally software solutions developed by Beeye to optimize task management and work planning. CED

Farmers can apply now for Innovate BC’s B.C. On-Farm Technology Adoption Program, with up to $2 million available from the governments of Canada and British Columbia this year. This second round of funding focuses on new commercially available farming technologies that will help grow, raise, harvest, pack or store food more effectively, productively or profitably. The program will fund labour-saving technologies that help address labour shortages and improve processes for labour-intensive tasks. Farmers can use the funding to buy new technologies, such as equipment and robotics that can operate independently and adapt to their environment. Examples are automated weeding equipment and harvesters or machinery that can perform tasks with minimal human interaction, like automated grading and sorting machines. Applications for this round of funding are open until October 6, 2024. Techcouver

RESEARCH, TECH NEWS & COLLABORATION

The University of Saskatchewan’s Vaccine and Infectious Disease Organization (VIDO) was awarded an Indefinite Delivery/Indefinite Quantity (IDIQ) contract under the pre-clinical models of infectious disease program by the U.S. National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH). The seven-year IDIQ contract’s ceiling is US$146.3 million. VIDO was one of four international awardees and the only Canadian organization selected as part of the program. The NIH is the largest public funder of biomedical research in the world. NIAID supports and facilitates research that focuses on understanding, treating, and preventing infectious, immunologic, and allergic diseases. Under the program, VIDO can help organizations bring new therapeutics, vaccines and diagnostics to market by testing them for their effectiveness against infectious diseases of high concern. University of Saskatchewan

The Université du Québec à Chicoutimi’s regional boreal forest research observatory has received $1.5 million from the Government of Québec to advance its strategic monitoring and scientific research on the boreal forest. With this funding, the Observatoire régional de recherche sur la forêt boréale will investigate emerging issues related to forest biodiversity, vulnerability and productivity. The observatory will also intensify its knowledge production and dissemination efforts to raise awareness about good forest management practices. Observatory director Yan Boucher said this provincial support will help the observatory focus on strengthening the resilience of communities and forests and support them in adapting to the context of climate change. Govt. of Quebec

Waterloo-based CMC Microsystems and McMaster University are partnering to advance research and develop new processes and training programs in the field of semiconductors and photonics. The partnership will see CMC expand its reach and join McMaster Innovation Park (MIP), which supports startups, business, and research. For CMC, strengthening its alliance with McMaster also ensures it supports research and innovation in the Hamilton ecosystem and beyond. The collaboration is important to FABrIC – a new partnership between CMC and Innovation, Science, and Economic Development Canada (ISED) announced July 4, 2024. ISED’s investment of $120 million over five years will enable FABrIC to develop new made-in-Canada semiconductor-based Internet of Things products, manufacturing options, and create a resilient and sustainable semiconductor ecosystem in Canada. McMaster University.

Two University of Saskatchewan research projects have received Canadian Space Agency (CSA) funding to use satellite technology for detailed mapping and analysis of the Earth’s surface. The projects are two of 17 supported by the CSA’s Research Opportunities in Satellite Earth Observation funding initiative. The CSA is providing $437,676 over three years to a project led by Dr. Steve Shirtliffe, PhD, at the College of Agriculture and Bioresources. The project, using a combination of satellite imagery, on-the-ground data and machine learning algorithms, will map “hot spots” in growers’ fields where the greenhouse gas nitrous oxide emissions (mostly related to nitrogen-based fertilizers) should be the greatest. The aim is early mitigation of potential high emissions areas. The CSA also is providing $312,000 over three years to a project led by Dr. Xulin Guo, PhD, department head of Geography and Planning in the College of Arts and Science. The research team aims to develop new ways to monitor woody plant encroachment and protect the grasslands of Saskatchewan and Canada, which are critical reservoirs of biodiversity and wildlife habitat. Sasktoday.ca

Sherbrooke, Que.-based startup SBQuantum has secured contracts with the European Space Agency (ESA) and the Canadian Space Agency (CSA) to test the company’s quantum diamond magnetometers in space. The sensor technology aims to enhance the accuracy and reliability of magnetic field monitoring and offers potential global positioning system backup solutions. The ESA aims to assess the reliability and accuracy of these sensors, particularly in monitoring Earth’s magnetic environment. This includes tracking magnetic storms, which can disrupt navigation and communication systems. The CSA selected SBQuantum to participate in CSA’s STRATOS Program, a stratospheric balloon program which tests technologies under extreme conditions. As part of this initiative, SBQuantum’s quantum diamond magnetometers will be deployed at altitudes of 40 kilometers, exposing them to temperatures as low as -60 degrees Celsius and significant radiation. The CSA’s project will also explore the potential of magnetic field-based positioning as a backup to traditional GPS systems, which can be unreliable in certain environments, such as conflict zones or remote areas. SBQuantum’s technology could play a key role in future space exploration and other industries, including Earth observation and mineral exploration. SBQuantum is a finalist in the MagQuest Challenge – a geomagnetic data competition run by NASA and an agency within the U.S. Defense Department. Space Impulse

Vancouver-based EarthDaily Analytics announced a $1.7-million, four-year contract with MySpatial, a Malaysia-based geospatial mapping company serving the government and private sectors. EarthDaily will provide MySpatial and its customers with data and analytics with applications focused on Civil Government, Agriculture, Environmental Monitoring and Protection, Natural Resources and Forestry, Urban and Infrastructure Development, Coastal Monitoring, Defense, Maritime Intelligence, and Enterprise. Under the contract, MySpatial and its customers have immediate access to EarthDaily Analytic’s current offering of high-quality Earth observation data and scalable, AI-driven analytics. EarthDaily plans to launch its 10-satellite EarthDaily Constellation in 2025. EarthDaily Analytics

Toronto-based Electra Battery Materials Corporation, a processor of low-carbon, ethically-sourced battery materials, announced it was awarded a $20-million contract from the U.S. Department of Defense. The funds will support the construction and commissioning of North America’s only cobalt sulfate refinery, capable of producing battery-grade materials for lithium-ion batteries. Today, more than 80 percent of battery-grade cobalt is produced in China. Electra’s $250-million refinery project is located north of Toronto, in Temiskaming Shores, and is projected to have the lowest carbon footprint in the world. The company is expanding an existing plant, with permits in hand and construction well underway. Once fully commissioned, the facility can produce 6,500 tonnes of cobalt per year, which would support the production of over one million electric vehicles annually. LG Energy Solution will purchase up to 80 percent of capacity over the first five years. Electra said the cobalt feed material will be “ethically-sourced” from Glencore and Eurasian Resources Group mines in the Democratic Republic of Congo – material that would otherwise be shipped to China. Electra is also contemplating a second cobalt sulfate facility in Bécancour, Quebec and a strategically located North American nickel sulfate plant. Meanwhile, research by scientists from Congo’s University of Lubumbashi found that four rivers near some of the country’s largest mines – including the Glencore and Eurasian Resources Group mines – are “hyper-acidic” or “very acidic.” Preliminary results indicating the rivers “have become unable to host fish, and that their water is toxic for human and animal health,” the researchers said. Congo’s miners use huge amounts of acid to process ore into copper and cobalt. Under the country’s mining law, companies are supposed to prevent toxic wastewater from contaminating groundwater or local waterways. Electra Battery Materials, Creamer Media’s Mining Weekly

British Columbia-based energy technology company Energy Plug Technologies Corp. and the Malahat Nation announced the official ground breaking and ground blessing ceremony for Canada’s first Indigenous-led gigafactory, a $75-million battery plant on Vancouver Island. With a targeted battery production output of one gigawatt-hour per year, the facility will manufacture energy storage systems for residential, commercial, utility and data centre markets across North America. The facility initially will assemble lithium iron phosphate battery storage packs for power grid, commercial and residential uses. The gigafactory will operate under Malahat Battery Technologies Limited Partnership, 51 percent owned by the Malahat Nation and 49 percent owned by Energy Plug. The 56,000-sq-ft facility is located on Malahat Nation’s reserve land. Financial contributions to build the facility will come from First Nations Finance Authority, Malahat Nation, Energy Plug, and private investors. It’s expected the gigafactory will be completed in the fourth quarter of 2025. Energy Plug

Dublin, Ireland-headquartered Linde, a global industrial gases and engineering company, announced it will invest more than $2 billion to build, own and operate a world-scale integrated clean hydrogen and atmospheric gases facility in Alberta. Linde signed a long-term agreement for the supply of clean hydrogen to Dow’s Path2Zero Project, located at Fort Saskatchewan just northeast of Edmonton. Linde’s new on-site complex will use autothermal reforming, combined with Linde’s proprietary HISORP® carbon capture technology, to produce clean hydrogen and also recover hydrogen contained in off-gases from Dow’s ethylene cracker. In the first phase, Linde will supply the clean hydrogen, nitrogen and other services to support Dow’s world-first net-zero emissions integrated ethylene cracker and derivatives site. Linde’s new facility will also supply clean hydrogen to existing and new industrial customers seeking to decarbonize their operations. In total, Linde’s complex will capture carbon dioxide emissions for sequestration in excess of 2 million tonnes each year. Upon completion in 2028, Linde’s new complex in Alberta will be the largest clean hydrogen production facility in Canada and one of the largest globally. It will be Linde’s largest single investment and its second new world-scale clean hydrogen project, following the announcement of its project to supply clean hydrogen to a major blue ammonia project in the U.S. Gulf Coast. Linde

Ford Motor Company cancelled its plans to make three-row (vehicles with third-row seating) all-electric SUVs, and will instead focus on hybrid technology vehicles (powered by an internal combustion engine and one or more electric motors) for its next three-row SUVs. As a result of this decision, Ford said the company will take a special non-cash charge of about $400 million for the write-down of certain product-specific manufacturing assets for the previously planned all-electric three-row SUVs, “which Ford will no longer produce.” In making the decision, Ford said it is “adjusting the cadence of product launches and realigning battery sourcing.” The company previously said it was delaying production of three-row all-electric EVs in Oakville, Ont., to 2027, but announced last month that it will make gasoline-powered and “multi-energy” (suggesting a hybrid setup) F-Series Super Duty trucks there instead. Ford Motor Company

Hydro-Québec subsidiary EVLO Energy Storage Inc. announced it completed commissioning of its first utility-scale, three-megawatt battery energy storage system (BESS) project in the U.S., in Troy, Vermont. The BESS will store energy during strong energy production times for later use during peak energy demand, helping to smooth out the intermittency of renewable power generation while delivering value to local utility customers. The Troy project will also provide data to the U.S. Department of Energy and Sandia National Laboratories to demonstrate how battery storage can enable the expansion of renewable energy production, while further integrating renewables into the New England grid. EVLO will monitor and maintain the BESS under a 20-year long-term service agreement, in partnership with Vermont utilities including the Vermont Electric Cooperative, which serves the town of Troy. BusinessWire

B.C. utility FortisBC Energy Inc. is working with Vancouver-based VulcanX Energy Corp. on the development of hydrogen pyrolysis technology that could see zero-emission hydrogen and solid carbon produced from natural gas at a low cost. FortisBC, which serves more than one million customers across British Columbia, is funding local startup VulcanX through FortisBC’s Clean Growth Innovation Fund. Spun out from MéridaLabs at the University of British Columbia, VulcanX is innovating hydrogen production through its technology to separate natural gas into its components of hydrogen and solid carbon. The technology is currently being tested at a demonstration facility in Fort Saskatchewan, Alberta. Funds from FortisBC will be used to support the front-end engineering and the detailed design of a potential facility capable of producing up to one tonne of hydrogen per day. VulcanX was a round three finalist in the 2024 New Ventures BC Competition this year and recently received a $75,000 non-dilutive investment from the B.C. Centre for Innovation and Clean Energy. FortisBC

BC Hydro has started filling its Site C dam reservoir as the contentious $16-billion megaproject nears completion. BC Hydro said filling the reservoir allows it to put the generating station, spillways, turbines and generators into operation. Over a period of up to four months, water will rise by up to three metres per day, creating permanent changes to the shoreline. The Site C reservoir will cover 5,550 hectares of land, with a total surface area of about 9,330 hectares. The 83-kilometre-long reservoir will be, on average, two to three times the width of the current Peace River. The final depth of the reservoir will vary: 52 metres close to the dam, 36 metres at Halfway River, and 18 metres near Hudson's Hope. The water used to fill the Site C reservoir comes from the upstream Williston Reservoir. Construction of Site C was launched in 2015 under then-Premier Christy Clark's B.C. Liberal government and has seen cost estimates balloon from up to $6.6 billion in 2007 to $16 billion in 2021. Multiple groups – including the Peace Valley Landowner Association, Prophet River First Nation and West Moberly First Nations – opposed the province's plan to complete the dam, including after the NDP formed government in B.C. in 2017. But former premier John Horgan said the dam needed to be finished despite his party not supporting the start of construction in the first place. B.C. Hydro says Site C will provide enough clean electricity to reliably power nearly 500,000 homes or 1.7 million electric vehicles when fully operational. BC Hydro, CBC News

A group of Massachusetts Institute of Technology (MIT) researchers have created what they described in an abstract as “a living database” of 777 risks of artificial intelligence. According to an article in MIT Technology Review outlining the initiative, “adopting AI can be fraught with danger. Systems could be biased or parrot falsehoods, or even become addictive. And that’s before you consider the possibility AI could be used to create new biological or chemical weapons, or even one day somehow spin out of control. To manage these potential risks, we first need to know what they are.” The AI Risk Repository was compiled by the FutureTech group at MIT’s CSAIL with a team of collaborators and published online. It is the most comprehensive source yet of information about previously identified issues that could arise from the creation and deployment of AI models. The team combed through peer-reviewed journal articles and preprint databases that detail AI risks. The most common risks centered around AI system safety and robustness (76 percent), unfair bias and discrimination (63 percent), and compromised privacy (61 percent). Less common risks tended to be more esoteric, such as the risk of creating AI with the ability to feel pain or to experience something akin to “death.” The database also shows that the majority of risks from AI are identified only after a model becomes accessible to the public. Only 10 percent of the risks studied were spotted before deployment. These findings may have implications for how we evaluate AI, as we currently tend to focus on ensuring a model is safe before it is launched. “What our database is saying is, the range of risks is substantial, not all of which can be checked ahead of time,” said Neil Thompson, director of MIT FutureTech and one of the creators of the database. Therefore, auditors, policymakers, and scientists at labs may want to monitor models after they are launched by regularly reviewing the risks they present post-deployment. MIT Technology Review

A group of experts is calling for the U.S. and other countries to pass legislation and set regulations to try to limit the risks posed by advanced AI models being applied to biology. AI models trained on biological data have double-edged potential to help scientists design new molecules and vaccines, but also to possibly be used to create new or enhanced viruses. Recent research from OpenAI, RAND and others argues today's large language models don't increase the risk of a bioweapon being created. The data to train them is limited and their predictions have to be experimentally validated, they said. But many researchers say the risk is likely to increase as AI models improve. "I think we need to listen to the AI developers about the potential capabilities of the next generation," said Anita Cicero, deputy director of the Johns Hopkins Center for Health Security. AI developers committing to evaluate models is "important but cannot stand alone," Cicero and her co-authors wrote in the journal Science. They propose that government regulations could start by requiring models trained with large computational resources on large amounts of biological data, and on models trained with sensitive biological data, to be evaluated before they are released. They also call for legislation requiring the providers of synthetic nucleic acids – which turn genetic sequence information into physical molecules – to screen their customers and their orders. Beginning in October, federally funded researchers in the U.S. will be required to get their synthetic nucleic acids from providers who do just that. Axios

More than 56 percent of Fortune 500 companies have now listed generative artificial intelligence as a “material risk” factor in their annual reports to the Securities and Exchange Commission – up from nine per cent in 2022, according to research by Berkeley, Calif.-based Arize AI. Ninety-two percent of media and entertainment companies in the Fortune 500 mentioned generative AI as a material risk – the highest percentage for any industry. But it’s not just media that’s worried. Constellation Brands, which makes Corona beer and Kim Crawford wines, has also listed AI as a risk factor in their SEC filing. For plenty of companies, AI is less of a direct competitive threat and more a security problem, like employees giving sensitive information to ChatGPT. The AI risks companies are worried about aren’t always external. For tech companies especially, the risk is coming from inside the house: Legal, regulatory and reputational threats come with deploying their own AI. But Arize AI CEO Jason Lopatecki said there’s a bigger risk behind the SEC disclosures. “AI is going to eat a lot of industries,” he said. “And ‘you don’t invest here, you are at risk,’ and I think that’s the tension you’re feeling.” For many companies, not investing in AI could be the riskiest path to take. Marketplace

Startup failures in the U.S. have surged by 60 percent in the past year, posing a threat to millions of jobs and potentially impacting the wider economy. Data from Carta, a provider of services to private companies, shows that 254 venture-backed clients went bankrupt in the first quarter of 2024, a rate more than seven times higher than in 2019. Notable casualties include Tally, a financial technology company valued at $855 million, and desk rental company WeWork, which had raised $16 billion in debt and equity. The rise in startup shutdowns comes as funding for early-stage AI startups slows, leading to concerns of a tech bubble burst. The trend threatens other startups attempting to develop their own AI large language models, and raises concerns that VCs cannot compete with Big Tech companies in terms of investment. An article in the European Business Review argues that the coming wave of AI startup failures is a natural part of the technology’s evolution, clearing the way for innovation and paving the road to broad adoption. The article suggests that the most robust and viable AI companies, those that have identified specific problems and built practical solutions, will continue to thrive. Furthermore, the failures create opportunities for other companies to acquire talent and innovative technology. However, the article also highlights the limitations of AI, including the difficulty of scaling due to hardware limitations and the need for significant processing power. PYMNTS Intelligence’s research shows that despite big budgets and ambitions, most large companies are struggling to employ AI in meaningful ways, with a significant gap between the perceived potential of AI and its actual application in the corporate world. PYMNTS

VC, PRIVATE INVESTMENT & ACQUISITIONS

Vancouver-based biotech startup Borealis Biosciences emerged from stealth operating mode with US$150 million (Cdn$202 million) in Series A funding. The Swiss pharmaceutical conglomerate Novartis AG and San Francisco-based VC fund Versant Ventures were the two backers in the round. Borealis, which was jointly launched by Novartis and Versant, is working on next-generation RNA medicines for kidney disease. Under the deal, Borealis will be in line for up to $750 million in milestone payments should Novartis take up its option of acquiring two development-ready programs from Borealis and continuing their journey to regulators. Much of Borealis’ 25-person team is made up of former researchers and executives at Chinook Therapeutics, another Vancouver-based kidney disease company founded by Versant in 2019 and acquired by Novartis last year in a deal worth up to US$3.5 billion. Fierce Biotech

Canadian Matt Loszak, one of the co-founders of Toronto-based human resources software startup Humi, has raised $27 million in Series A financing for his latest venture: nuclear power startup Aalo Atomics, based in Austin, Texas. The round was co-led by pre-seed and seed-focused VC firm Fifty Years and SpaceX backer Valor Equity Partners, with participation from Harpoon Ventures, Crosscut, SNR, and Alumni Ventures, among others. Aalo claims its nuclear technology will be able to reduce costs and improve safety by using a combination of metallic coolant and uranium zirconium hydride fuel. According to the company, the metallic coolant extracts heat from the reactor core more efficiently than current technology, which it claims could enable Aalo reactors to produce up to 10 times more energy than similarly sized technologies. Aalo’s first product, currently in development, will be a reactor called the Aalo-1, which is inspired by the Idaho National Laboratory’s Microreactor Applications Research Validation and Evaluation (MARVEL) microreactor, which is expected to come online as soon as late 2026. Top Tech 100

Toronto-based Viggle AI raised US$19 million in Series funding led by Andreessen Horowitz (a16z), with participation from additional investor Two Small Fish. Viggle AI is a startup utilizing generative artificial intelligence in character animation. The company was founded to simplify the animation process by allowing users to create lifelike animations using simple text-to-video or image-to-video prompts. Viggle CEO Hang Chu worked on a doctorate in computer vision at the University of Toronto, under Waabi CEO Raquel Urtasun and Nvidia executive Sanja Fidler. Viggle AI said the financing will enable it to continue to scale, accelerate product development, expand its team and solidify its position as a leader in controllable video generation and AI animation. BetaKit

Montreal- and Berlin, Germany-based Reliant AI emerged from stealth operating mode with $15.4 million in funding. The new capital was co-led by Tola Capital and Inovia Capital, with participation from angel investor Mike Volpi. Reliant AI was created by scientists and researchers who led teams at DeepMind, Google Brain and EY Parthenon. Chief scientific officer Marc Bellemare is CIFAR AI chair at Mila – Quebec AI Institute. Reliant AI is initially targeting its AI-driven data analytics software to the biopharma industry, with its Reliant Tabular product. The product helps life science analysts find scientific evidence for their decisions through automated systematic reviews, asset scans, comprehensive analyses and a customizable data platform. Reliant said it will use the funding to hire engineering talent to expand its technology investment and footprints in Europe and North America. Reliant AI

Montreal-based insurance marketplace startup YouSet raised $3.5 million in a seed round of financing. The funding comes from investors who had participated in YouSet’s $2.1-million pre-seed round announced in 2022, and new strategic angel investors. YouSet was founded to save Canadians time and money when shopping for insurance. With YouSet’s online platform, users can seamlessly compare rates from major insurers, saving them nearly 30 percent on average, the company said. The company also announced its latest innovation, offering bundled insurance policies from multiple insurers and an additional 15 percent in savings when purchasing the bundle. The company will use the funding to expand the sales, customer service and marketing teams, and to grow its network of distribution partners. YouSet

Canadian-founded startup Tmrw, based in Miami, raised $1.8 million in pre-seed funding to develop a social payment app that uses Bitcoin for cross-border transactions. The startup was founded by Canadians Ari Ramdial and Alexandra Lutchman, both of whom have a background in crypto through their previous venture, Montreal-based Knox Custody. Tmrw aims to provide a faster and cheaper alternative to traditional remittance services like Western Union, initially focusing on the Caribbean market. Tmrw’s platform, built on the Bitcoin Lightning Network, will allow users in the U.S. to send money to family and friends in the Caribbean and Central and South America. Recipients can withdraw funds in cash, even without a bank account. Founders Today

Vancouver-based Arca Climate Technologies received an undisclosed investment from InBC, a strategic investment fund created by the Government of British Columbia with $500 million to invest in growing companies and venture funds. Arca’s carbon dioxide (CO2) removal technology significantly speeds up the natural process of carbon mineralization occurring in ultramafic rocks. The company was spun out of the University of British Columbia by a team of scientists and entrepreneurs aiming to address climate change. Arca is partnering with the critical minerals industry where ultramafic rock is abundant in the form of mine tailings. Earlier this year, Arca won the Startup of the Year award at the BC Cleantech Awards and the company is a top 20 finalist in the prestigious XPRIZE Carbon Removal competition. Techcouver

Markham, Ont.-based Book4Time, a spa management company, was acquired by Georgia-based Agilysys in an all-cash deal for US$150 million (Cdn$204 million). Agilysys delivers software solutions and services, focusing on maximizing return on experience through guest interactions. Book4Time manages guest experiences at spas, international hotels, resorts, casinos, golf and private member clubs in more than 100 countries. Book4Time’s cloud-based platform's capabilities include managing appointments, staff and inventory, while also improving guest experiences and providing comprehensive corporate reporting. Agilysys

Toronto-based Givex Corp. has agreed to be acquired by Pennsylvania-based Shift4 Payments Inc. in an all-cash shares purchase deal that values Givex at $200 million. Givex is a cloud-based global customer engagement and business insights platform that provides businesses with end-to-end point-of-sale, customer loyalty, and event ticketing tools and analytics. Shift4, listed on the New York Stock Exchange, provides a point-of-sale payments processing and gift card solutions platform to retailers, restaurants, casinos and hotels. Under the deal, Givex shareholders will receive $1.50 in chase for each Givex share held. That share price represents a 64-percent premium to Givex’s share price on the Toronto Stock Exchange ending August 23, 2024, the last trading day prior to the announcement of the deal. Givex

Toronto-based Bitfarms will acquire rival bitcoin miner Pennsylvania-based Stronghold Digital in an all-stock transaction that values Stronghold at US$175 million. The deal comes amid an ongoing dispute with Bitfarms shareholder Riot Platforms, which has been steadily increasing its stake in Bitfarms over recent months, following a rejected US$950-million takeover bid. Bitcoin mining is an energy-intensive process involving mining devices and software that compete to solve a cryptographic problem. The addition of Stronghold and its assets will increase the “hashrate” (the speed at which a bitcoin mining machine operates), which requires more computing power and increased energy costs. Stronghold currently has 165 megawatts of generated power capacity, as well as 142 MW of import capacity through a Pennsylvania-New Jersey-Maryland interconnection. Up to 790 MW of potential power is said to be available for import beyond 2025. The Deep Dive

REPORTS & POLICIES

No correlation between capital gains taxes and Canadian businesses’ investment and innovation, report says

There is no historic correlation between capital gains taxes and business investment in machinery, equipment, research or innovation, says a new report by economist Dr. Jim Stanford, PhD.

Canada’s strongest sustained technology investment performance was in the 1980s and 1990s, when capital gains inclusion was 66.7 percent or 75 percent – higher than the current 50 percent, according to his report.

Most corporate capital gains are captured by industries that buy and sell assets, rather than engaging in direct production, the report says. A growing share (over one-third) is captured by financial firms.

The report, Fact and Fiction on Capital Gains Taxation, was co-published by two think tanks: the Centre for Future Work and l'Institut de recherche et d’informations socioéconomiques.

Capital gains reported by Canadian corporations have doubled since the COVID pandemic, and risen 11-fold since 2002, according to the report. Corporate capital gains set a new record in 2022 of $87 billion.

The biggest recipients of corporate capital gains, in general, have very poor job-creation records, the report says. In the last five years, the biggest recipients (“Miscellaneous Intermediation” and “Real Estate”) received over half of all corporate capital gains, but between them created no net new jobs.

The vast majority of corporate capital gains arise from speculative financial and property sales, the report says. The professional, technical and scientific sector received less than three per cent of all corporate capital gains in 2022.

“Preferential tax treatment of capital gains has no predictable impact on real investment or job-creation,” Stanford, economist and director at the Vancouver-based Centre for Future Work, said in a statement.

“A small group of high-income Canadians and powerful corporations have a vested interest in maintaining capital gains tax preferences, because they save tens of billions of dollars per year in taxes,” he said.

“Treating capital gains more equally with other types of income is not just fair, it will also reduce economic distortions that are undermining real investment and job-creation.”

The findings in Stanford’s report are at odds with what the Canadian Venture Capital & Private Equity Association, the Council of Canadian Innovators, the Fraser Institute, tech company CEOs and others maintain will be the impact of the federal government’s increase in the capital gains inclusion rate, announced in Budget 2024.

Ottawa intends to increase the rate from 50 percent to 66.7 percent for corporations and trusts, and from 50 percent to 66.7 percent on the portion of capital gains realized in the year that exceed $250,000 for individuals.

Critics contend the increase will deter business investment in the Canadian economy, chase away capital needed for new equipment and technologies, drive entrepreneurial startups to other countries that have more attractive tax policies, stifle innovation and economic growth, and hurt middle-class Canadians.

But Stanford’s report points out that business capital spending has declined substantially under lower tax rates.

Spending on tangible machinery and equipment by Canadian businesses averaged around six percent of Canadian GDP until 2000 – when the capital gains inclusion rate was reduced from 75 percent to 50 percent, and corporate income taxes were also cut deeply, as well.

Since then, machinery and equipment investment has declined steadily. Business spending on intangible innovation (such as R&D, computer software, etc.) has also stagnated: it nearly doubled as a share of GDP in the 1990s (when the inclusion rate was 75 percent), but has not grown since.

“There is no evidence of a predictable impact of capital gains inclusion on the rate of investment by Canadian businesses in new technology – whether tangible machinery and equipment, or intangible investments in research and intellectual property.”

The report notes that a well-known problem in Canada’s R&D underperformance is the tendency by successful Canadian startup firms to sell out to bigger buyers (usually based in the U.S. or other countries), rather than sustaining their businesses through a longer-term process of expansion.

In this context, the report says, making the sale of a business more appealing on tax grounds (which is the effect of tax loopholes for capital gains) has counter-productive implications for growing Canada’s high-tech sector.

If the goal of policy is to support more investment, innovation and growth in technology-intensive industries, the current system of capital gains partial inclusion is incredibly inefficient, the report adds. “It would be far more efficient for government to directly subsidize or target desired technology investments, rather than dispersing tens of billions in tax subsidies across a whole range of industries (most of which have little if anything to do with technological innovation).”

According to Stanford’s report, the vast majority of capital gains are received by the highest-income 1.5-percent of Canadian households, and by corporations in sectors (like financial intermediation and real estate) that focus on buying and re-selling assets – not production, innovation or job-creation.

The highest-income 1.5-percent of tax-filers (those with total income over $250,000) receive 61 percent of individual capital gains, and 67 percent of tax savings from partial inclusion of capital gains, the report says.

Only about 0.1 percent, or about 40,000 people, report over $250,000 capital gains per year, according to Canada Revenue Agency data.

Capital gains are more concentrated among very high-income tax-filers than any other kind of income – even more than other forms of investment income (like dividends or interest).

Most very high-income tax-filers (over $250,000) report capital gains, and the average amount those with capital gains report is over $180,000 per year (not counting the capital gains those tax-filers are allowed to exclude). Average tax savings for those claimants (under the previous 50-percent inclusion rate) is estimated at $95,000 per year.

For very high-income tax-filers, capital gains make up 18 percent of their total incomes. For those with less than $100,000 income, capital gains make up less than one percent of their (much smaller) total incomes.

Until this year, recipients only had to declare half their capital gains on their income tax (for a so-called “inclusion rate” of 50 percent), the report says. “The other half was entirely tax-free. In contrast, other forms of income (like wages and salaries) must be fully reported on a tax return: in other words, their ‘inclusion rate’ is 100 percent.”

Capital gains have grown seven times faster than overall personal income, and have tripled as a share of total assessed income (per tax-filer).

“This is partly due to very high profits on financial assets and real estate. But it also reflects efforts by tax-filers (and their accountants) to convert income into capital gains and thus maximize tax savings.”

Even with the changes to the capital gains inclusion rate, the report notes that those affected by the changes would still see half of their first $250,000 in capital gains being fully tax-free. One-third of anything above that threshold is also fully tax-free.

Several provisions in the tax code allow most capital gains claimants to further reduce their taxes, including: exemptions for small businesses and farms and principal residences; a new lower inclusion rate for entrepreneurs; provisions for splitting capital gains (and taxes on them) over several years; and special exemptions for transferring capital assets to family members.

Capital gains taxes don’t affect the continuing operation of farms, including family farms – they only kick in when an owner of a farm sells their property, the report says.

So the government’s reform in capital gains taxes does not affect working farms; rather, it affects people who want to sell their farms. The biggest capital gains for a “lucky few farmers” are accrued on farms near larger towns or cities that are sold off for residential or commercial development, the report says.

“Those farms become worth many millions of dollars – not for growing food, but for property development. In this regard, capital gains loopholes are a subsidy for the diminishment of agricultural activity, not its continuation.”

Capital gains increase the ratio of inequality between top and average incomes by 16 per cent, the report notes.

Even with the changes, it says, “Capital gains income will still be taxed less intensely than other forms of income, and most of the enormous loss of tax revenue resulting from these preferences will continue.”

Federal revenues were reduced by $38 billion in 2021 due to the partial inclusion of capital gains for individuals, trusts, and corporations. Provincial governments lost many billions more.

Finance Canada forecasts that revenue losses from continuing the 50-percent inclusion rate will range between $25 billion and $30 billion annually in coming years, the report says. The changes to the inclusion rate will reduce these revenue losses by several billion dollars per year.

Says the report: “The federal government’s tax reform is a modest but overdue effort to rein in a surge of tax-subsidized profits – the vast majority of which is captured by the richest households, and the most speculative industries.”

“Capital gains tax loopholes do not help the middle class. They overwhelmingly aid the rich. It’s well past time to rein them in,” Stanford said. Centre for Future Work

*******************************************************************************************************************************

International students not to blame for Canada’s housing crisis: University of Waterloo study

There is no basis for blaming international students for Canada’s housing crisis, says a new study by University of Waterloo (UWaterloo) researchers.

There have been ongoing accusations that international students are flooding university towns and taking up all the affordable housing.

But the study, led by a research team at UWaterloo’s Faculty of Environment, debunks popular myths about international students.

For example, international students are often perceived as temporary visitors who are young, hyper mobile and care-free individuals. While some may fit this demographic, the researchers point out that the reality is much different.

The study, Learning from International Student Families, Making a Home in Canada, was supported by the Social Sciences and Humanities Research Council of Canada.

Currently, one in five international students is estimated to live with their partner and children during their study, and these families are overlooked in Canada’s policy and planning in higher education, migration and housing.

“The needs of international student families haven’t really been discussed,” said Dr. Alkim Karaagac, PhD, researcher in the Department of Geography and Environmental Management and principal investigator of the study. “There is an invisibility and silence, which is a perfect recipe for vulnerability and exploitation.”

Focusing on this vulnerable population, the researchers conducted a two-year case study on the housing experiences of 21 international student families living off-campus in the Waterloo region. International students comprise 41 percent of UWaterloo’s total graduate student body.

The region is a unique location to investigate, given it has the largest purpose-built student housing market in the country and is reported to have one of the least affordable housing markets among Canadian university towns.

The researchers’ interviews focused on the lived experiences of international students making a home in Canada and the challenges they face in the housing market. The findings suggest that all international student families face many hurdles to finding adequate housing – plus there are not enough diverse options to fit their needs.

“We talked to a family who had been living in an Airbnb for the last eight months who used up all their savings on tuition and housing,” Karaagac said. “While the Airbnb is expensive, when you settle somewhere and the kids start school, you cannot just move somewhere else. Especially when there aren’t a lot of options.”

Other countries don’t share these problems. Subsequent interviews with experts that can speak to the housing crisis detailed how the U.S. and U.K. support their international students with subsidized housing. From these conversations, plus a review of government documents and reports, Karaagac and her team put forward a series of recommendations.

International students should receive accurate information on university housing, waiting lists, cost of living and housing in the local context, Karaagac said. They also need hands-on support when applying for housing, so they don’t fall victim to fraud, and they need help upon arrival as they navigate their first week.

The researchers believe these short-term actions can be complemented by longer-term actions, such as implementing polices and bylaws that curb rental scams and discrimination by property owners.

Creating partnerships with housing market actors can lead to creative affordable housing solutions, and it is essential to expand how universities in towns can be more interconnected with town centres, the researchers said.

“We need to see international students as complex and more than one type of student. They are a diverse group which you can’t house in a standard dormitory. We need to step up and be prepared as towns, universities and provinces to support them,” Karaagac said. UWaterloo

*******************************************************************************************************************************

Federal cap on international students is already having major impacts, CICan says

The federal government’s cap on study permits for international students is having a significant impact and post-secondary students are preparing for “big and unintended consequences,” says Pari Johnston, president and CEO of Colleges & Institutes Canada (CICan).

Publicly available data from Immigration, Refugees and Citizenship Canada shows that international student applications are down 36 percent year-over-year, Johnston said in a statement.

For CICan members in particular – Canada’s network publicly funded colleges, institutes, cégeps, and polytechnics – applications are down as much as 54 per cent, she said.

The cap is already at risk of worsening a long-term trend of reduced provincial spending, tuition freezes and rising costs for post-secondary institutions, Johnston said.

Already, some institutions are reducing hiring and academic staff. Institutions are limiting intakes for some programs, while others are cutting whole programs – including in critical areas like early childhood education, continuing care, and environmental technologies.

Institutions also are reducing some commercial research activities and student outreach programs, she said. “If we’re not careful, we could irreparably damage our publicly funded postsecondary education system.”

Fewer international students not only limits access to training for Canadian students that is vital to growing key sectors of our economy – particularly in rural, remote, northern, and Indigenous communities – but threatens the vitality of our sector as a whole, Johnston said.

In 2022 alone, international students contributed $30.9 billion to Canada’s economy and supported 360,000 jobs, she noted.

Canada needs to pause and reassess how these abrupt policy changes could undermine the sustainability of a sector vital to the public good, Johnston said.

“The path forward is thoughtful policy-making that recognizes the interconnectedness of international students, colleges and institutes within Canada’s broader economic and social landscape.” CICan

*******************************************************************************************************************************

Ontario puts moratorium on colleges offering postsecondary programming outside of Canada

The Government of Ontario announced that the province’s 24 publicly supported colleges will no longer be allowed to enter new contracts or arrangements to offer postsecondary programming outside of Canada.

The moratorium will remain in place until at least early 2025. Jill Dunlop, minister of colleges and universities who has since been appointed minister of education, said in a memo sent on August 19 that the moratorium will cover the establishment of new branch campuses, partnerships/curriculum licensing agreements, curriculum development arrangements, and more.

Existing international activities will be allowed to continue without expansion, and student recruitment and research partnerships will not be affected.

Colleges Ontario president Marketa Evans expressed alarm over the change. “These entrepreneurial initiatives help offset costs to ensure that college programs stay open for Ontarians,” Evans said. “We at Colleges Ontario are increasingly concerned about the strength of the sector and its ability to continue to deliver for Ontarians.” Toronto Star, ICEF Monitor

*******************************************************************************************************************************

Quebec to limit temporary foreign workers and international students

The Government of Quebec announced measures to curb the growth in the number of non-permanent residents in Montreal.

As of September 3, for a period of six months, the receipt of applications for the Temporary Foreign Worker Program will be suspended for jobs in the Montreal area whose offered wage is below the median wage in Quebec ($57,000).

Exemptions are provided for applications related to certain strategic sectors of economic activity such as health, education, construction, agriculture and food processing.

The Legault government also intends to equip itself with legal levers to better regulate the arrival of foreign students in Quebec. It is necessary to be able to limit the number of applications made by international students based on several factors such as the type of institution, the number of international students per institution, the region, the level of study and other factors, the government said in a statement.

A bill will be tabled this fall to this effect and will also aim to better monitor the situation of international students in Quebec in order to support the implementation of targeted limitations and supervision.

The government said the number of non-permanent residents in Quebec, mainly asylum seekers, temporary foreign workers and international students, almost doubled between 2021 and 2024, from about 300,000 to 600,000 as of April 1, 2024.

“The Government of Quebec is therefore taking action to reduce the number of immigrants in Montreal in order to protect the French language and limit the impact on the availability of housing and our public services.” Govt. of Quebec

*******************************************************************************************************************************

Australia announces international student enrolment caps

The Australian government announced its planned international student enrolment caps levels for 2025, focused on the higher education and vocational sectors and approximately based on 2023 levels.

The caps, subject to the successful passage of the Education Services for Overseas Students Amendment (Quality and Integrity) Bill 2024 currently being debated in parliament, will set a National Planning Level (NPL) of 270,000 enrolments for the 2025 calendar year.

This will bring international student enrolment back to pre-COVID pandemic levels, strengthen the integrity of the sector and ensure it maintains its social license, the government said.

Students taking standalone English language courses, higher degree research students, non-award students, Australian and government-sponsored scholars, key partner foreign government scholarship students, and students from the Pacific and Timor-Leste are excluded from the NPL, the government said.

Publicly funded universities will be limited to 145,000 new international student commencements in 2025, which the government said was similar to 2023 levels.

Independent universities and non-university higher education providers will receive around 30,000 new international student commencements in 2025.

For vocational education and training providers, there will be around 95,000 international student commencements in 2025.

Professor David Lloyd, chair of Universities Australia, criticized the imposition of a cap.

“We acknowledge the Government’s right to control migration numbers, but this should not be done at the expense of any one sector, particularly one as economically important as education,” he said in a statement.

“Curtailing growth in the AUS$48 billion international education sector risks our nation’s ambition and the university sector’s ability to support the delivery of national priorities,” Lloyd said. Study Travel Network

****************************************************************************************************************************

Priortize Canada’s immigration system for highly skilled immigrations to maximize GDP per capita: C.D. Howe Institute report

Canada’s immigration system should prioritize attracting skilled immigrants with the goal of maximizing GDP per capita in the full population, including newcomers, says a commentary report by the C.D. Howe Institute.

An economic immigration program designed to simply expand the labour force without raising the average human capital, or skill level, of the population is unlikely to increase GDP per capita in the long run, according to the policy think tank’s report.

The post-COVID pandemic years have seen federal government policy prioritize plugging holes in lower-skilled labour markets, which is consistent with popular notions that some types of labour are “essential” to production, the report says.

Instead, it says, Canada’s economic-class immigration system should return to its successful roots by prioritizing highly skilled newcomers based on expected earnings levels.

The selection of “economic immigrants” should proceed based on human capital in descending order from the highest, until the marginal immigrant admitted has human capital equal to the average in the full population, the report recommends.

Expected annual earnings for immigrants should be used as a proxy for human capital, it says. Economic immigrants should be given 10 years to adapt.

So, prospective immigrants should be admitted to Canada if their expected incomes at least 10 years after arrival are at or above the average of the full Canadian population, the report says.

Model simulations suggest imposing the restriction that earnings 10 years after arrival are at least as great as the population average could require reducing the level of immigration by 25 percent or more, the report adds, “but would result in substantially higher immigrant earnings.”

However, using better prediction models and richer information on the immigrant data employed would likely result in “a less drastic reduction in [immigration] admissions.”

The report, Optimizing Immigration for Economic Growth, was written by Matthew Doyle, Mikal Skuterud and Christopher Worswick.

Doyle is an associate professor of economics at the University of Waterloo. Skuterud is a professor of economics at UWaterloo and a fellow-in-residence at the C.D. Howe Institute. Worswick is professor and chair of the Department of Economics at Carleton University.

Weak capital investments and productivity growth suggest that Canada is not well-positioned to leverage heightened immigration to raise either the level or the growth rate of per capita GDP, their report says. “We argue that these data caution against large-scale increases in economic immigration rates in the near term due to absorptive capacity issues.”

The preferred approach is to gradually increase immigration rates by starting with a high threshold level for expected immigrant earnings and gradually lowering it towards the overall population average, the report says.

“This would prioritize the applicants with the highest human capital levels and expected earnings, whose contributions to the Canadian economy are likely to have the largest positive impact.”

Between 2000 and 2017, Canada’s annual immigration rate – the number of new permanent residents as a percentage of the population – fluctuated between 0.70 percent and 0.83 percent.

In 2017, the government announced expansionary targets, which served to increase the rate over the following two years to 0.87 percent and 0.91 percent.

While COVID-19 travel restrictions forced a reduction in 2020 to 0.49 percent, 2021 saw the rate increase to 1.12 percent, its highest since 1957.

If the federal government meets its most recent targets – 485,000 new permanent residents in 2024 and 500,000 in 2025 – the rate will reach 1.21 percent and 1.24 percent, respectively, the report says. “Canada has not seen consecutive years with rates above 1.2 percent since 1928-1929.”

The shortfall in Canadian productivity growth was especially large over the period from 2001 to 2011, a period during which Canada’s annual immigration rate was on average more than twice the U.S. rate, the report notes.

In fact, the Canadian immigration rate exceeded the U.S. rate in every year between 1985 and 2021 and was more than twice as high as the U.S. rate in 31 of the 37 years.

“While there remains a lot we do not know about the causes of Canada’s sluggish productivity performance, these data do not provide us with much confidence that simply increasing Canada’s immigration rate will be a tonic to Canada’s ongoing productivity challenge.”

When it comes to the relationship between innovation and productivity, some argue there is scope for immigration policy to influence productivity growth, for example by an immigration policy focused on attracting scientists, inventors and entrepreneurs.

However, the report points out an important caveat is that innovation primarily takes the form of new ideas. Ideas are public goods in the sense that a person’s decision to use an existing idea does not preclude others from using the same idea.

Furthermore, by their very nature, ideas cross national boundaries relatively easily. Canada is highly integrated into both the North American and global economies and has a highly educated work force and a well-developed system of universities, and therefore has access to the global pool of new ideas and discoveries, the report notes.

“This suggests that domestic productivity growth in Canada is likely to depend more strongly on the global than on the domestic rate of innovation.” Essentially, all countries benefit from ideas created throughout the world.

Given the current high immigration levels, exceptionally high temporary migration levels and strains on the housing and healthcare sectors, the federal government should apply the insights from the report’s analysis and reassess immigration and temporary migration targets, the researchers say.

The federal government has cut the intake of international students, “but this may well prove insufficient, the report says. “Unless significant steps are taken to improve the system used to screen applicants for economic-class immigration, our analysis suggests that actual cuts to the level of economic immigration are likely needed.” C.D. Howe Institute