Is income and wealth inequality really a problem for Canada?

Peter Josty is Executive Director of The Centre for Innovation Studies, based in Calgary.

Peter Josty is Executive Director of The Centre for Innovation Studies, based in Calgary.

Populations are unequal in many ways. People’s height and weight are unequal. Musical abilities and many other abilities are not equally distributed. None of this causes any problems.

But when it comes to inequalities around money – income and wealth – it is a different story. Is this concern justified?

Measuring inequality is complicated. You can measure wealth or income inequality. You can measure income before tax, after tax, before or after social payments such as employment insurance, or you can measure disposable income. Wealth can be measured before or after tax. You can measure wealth per person or per household.

Statistically you can calculate a Gini coefficient for any of these measures. This measure is zero for complete equality and one for complete inequality. Wealth inequality is always larger than income inequality.

Inequality in Canada

According to Statistics Canada, in terms of wealth inequality, the richest 20 percent of Canadians owned 67.7 percent of the country’s total wealth at the end of 2023, an average of $3.3 million per household.

The bottom 40 percent of households held only 2.7 percent of total wealth, an average of $67,038 per household.

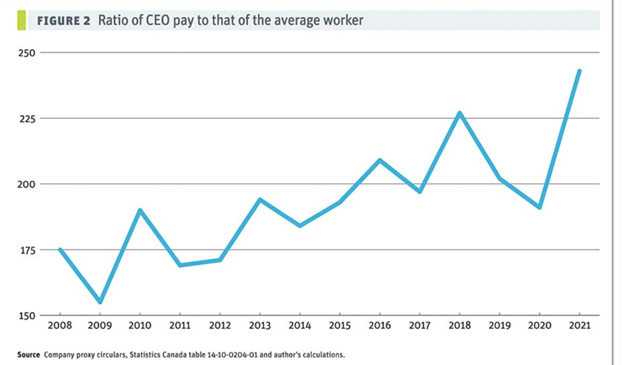

Income inequality has risen in recent years. One reflection of this is the ratio of CEO pay to that of the average worker, as shown in the graphic below from PressProgress.

International comparisons

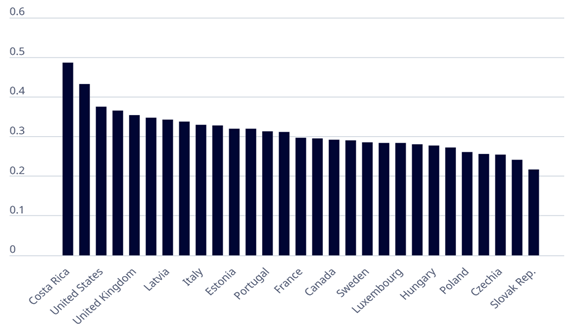

According to the Organisation for Economic Co-operation and Development, Canada is in the middle of the pack when measuring the Gini index (on a scale of 0 to 1) for disposable household income, more equal than the U.S. or the U.K. and similar to France and Sweden (see graphic below: 0 for complete equality and 1 for complete inequality).

Source: OECD

Inequality in the U.S. is much higher than in Canada. For instance, the before-tax income share of the wealthiest top one percent in the U.S. was 21 percent of the country’s total wealth compared with 11 percent in Canada, according to the World Inequality database. The top one percent owned 35 percent of net personal wealth in the U.S. in 2022, compared with 25 percent in Canada.

History of inequality

As French economist Thomas Piketty showed, inequality has gone through significant cycles during the 100 years. The graphic below shows how the income attributed to the top one percent has changed in Canada over the past 100 years. The period from about 1940 to 1980 was the most equal period.

.png)

Source: World Inequality database

Why does this matter for the economy?

The current evidence from the U.S. appears to demonstrate that high levels of inequality do not slow down economic growth. The U.S. is among the most unequal countries in the world and is currently demonstrating stronger economic growth than most other countries.

The National Bureau of Economic Research in the U.S. concluded that high levels of inequality reduce growth in relatively poor countries but encourage growth in richer countries.

So, the evidence would appear to show that higher inequality actually helps economic growth.

What is the effect of inequality on society?

According to the International Monetary Fund, excessive inequality can erode social cohesion, and lead to political polarization.

The World Bank says extreme inequality can lead to entrenched poverty, stifled growth and social conflict. There is a large literature showing the negative social effects of elevated levels of income inequality.

Historically, some societies have remained stable for extended periods with very high levels of inequality, for example the medieval period in Europe and 19th century Britain. But rapid increases in inequality give rise to polarization, lower social mobility generate resentment and lead to political instability.

It has been well documented that there is a strong relationship between income and good health. A report from the JAMA Network revealed the startling fact that the top one percent of the richest people in the U.S. live 14.6 years longer than the poorest one percent, on average.

How to decrease income inequality

It is not possible to recreate the situation between 1940 and 1980 where income inequality was very low in Canada, because the world has changed so much.

The Conference Board of Canada (CBoC) proposes that a well-targeted, means-tested minimum income, distributed federally, could help to efficiently alleviate income inequality among disparate groups.

The CBoC also suggests that inheritance taxes could improve outcomes further and notes that access to health, education and daycare also contribute to reducing inequality.

Conclusion

High income inequality is not a problem for economic growth as evidence suggests that higher inequality increases economic growth.

But income and wealth inequality is a major problem for society as it can reduce social cohesion and lead to resentment, polarization and political instability.

Some might argue that the resentment and polarization we’re seeing in Canada, the U.S. and other countries is at least partly the result of income and wealth inequality.

Income inequality has risen in Canada since about 1980 but has declined over the last 20 years or so. It is similar to that of France and Sweden and far less than in the U.S.

Proposals to reduce income inequality include a targeted means-tested minimum income, inheritance taxes and better access to health, education, and daycare.

Pursuing economic growth and productivity at the cost of widening income and wealth inequality can lead to serious social problems.

R$

| Organizations: | |

| People: | |

| Topics: |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 1 free article remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.