Transforming Canada’s innovation ecosystem for global competitiveness

Guest ContributorJanuary 29, 2025

By Ömer Kaya

Ömer Kaya is chief executive officer of Global Advantage Consulting Group, an Ottawa-based consulting firm specialized in strategy, data analytics and ecosystem transformation.

Ömer Kaya is chief executive officer of Global Advantage Consulting Group, an Ottawa-based consulting firm specialized in strategy, data analytics and ecosystem transformation.

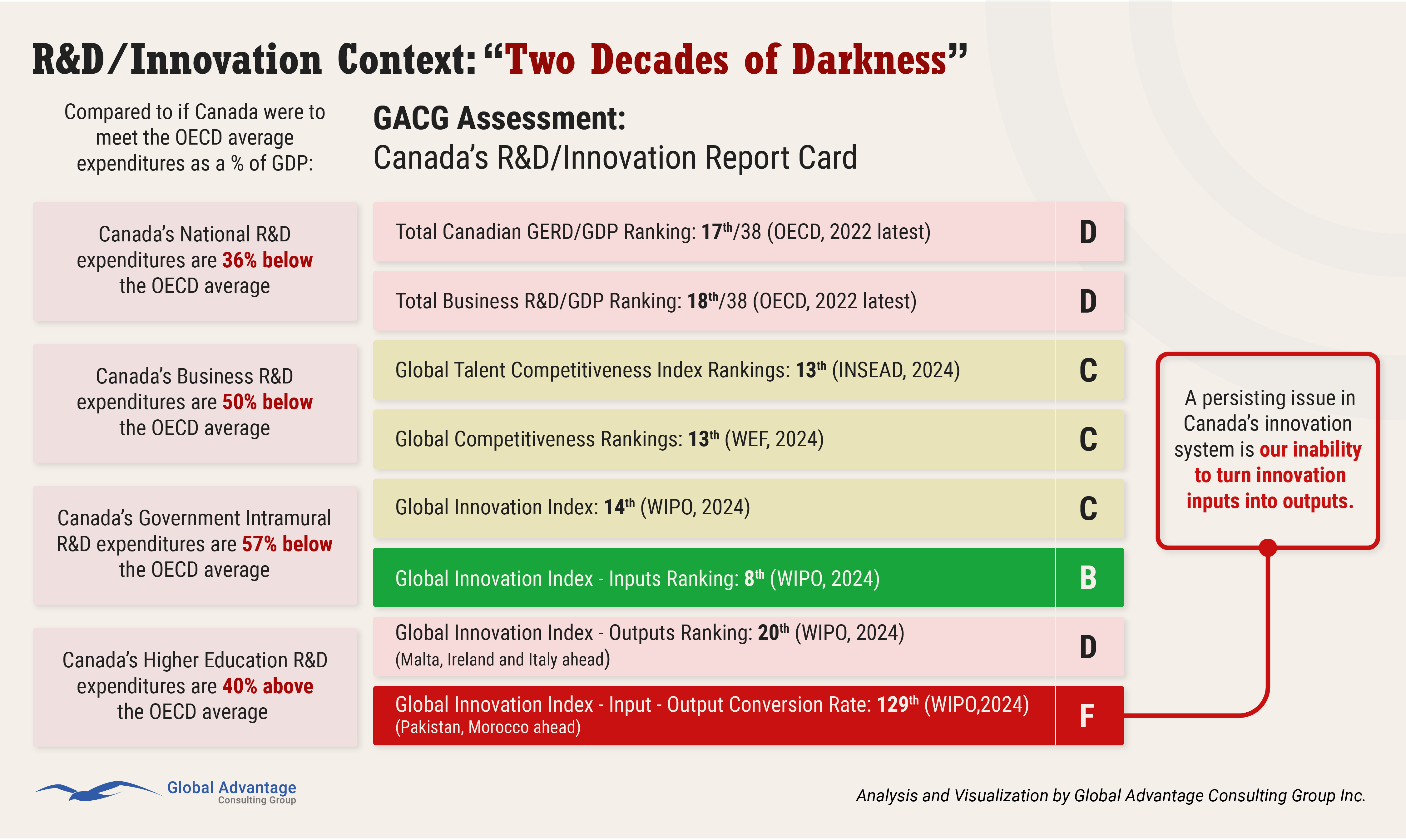

Canada has the talent, resources and potential to be a global innovation leader. Yet it ranks 14th in the World Intellectual Property Organization’s Global Innovation Index 2024 – 8th in innovation inputs and 20th in outputs – falling well behind other advanced economies.

This disconnect between potential and performance demands urgent action to transform Canada’s innovation ecosystem for global competitiveness.

Innovation performance in Canada has long been a significant concern. There is general consensus that Canada must address the problem of poor performance in turning its research and technology into commercialized innovations.

Although the country invests in innovation in the form of research and development, education, infrastructure and strong institutions supplying support for innovative activities, translation of these inputs into innovation outputs (application, exploitation and impact) is not happening consistently and at scale.

Innovation performance is closely tied to competitiveness and economic productivity, which is in a state of “emergency,” as noted by Carolyn Rogers, senior deputy governor of the Bank of Canada, in March 2024. Productivity and competitiveness lead to faster growth, more jobs and higher wages, and ensure Canada’s ability to sustain public investments in social, health, and environmental priorities – all critical to the wellbeing of its citizens.

Addressing Canada’s R&D and innovation investment gap

R&D activities are a fundamental component of innovation. In 2022, Canada accounted for only about 1.3 percent of global R&D investments. On the other hand, the U.S. and China combined accounted for 55 percent.

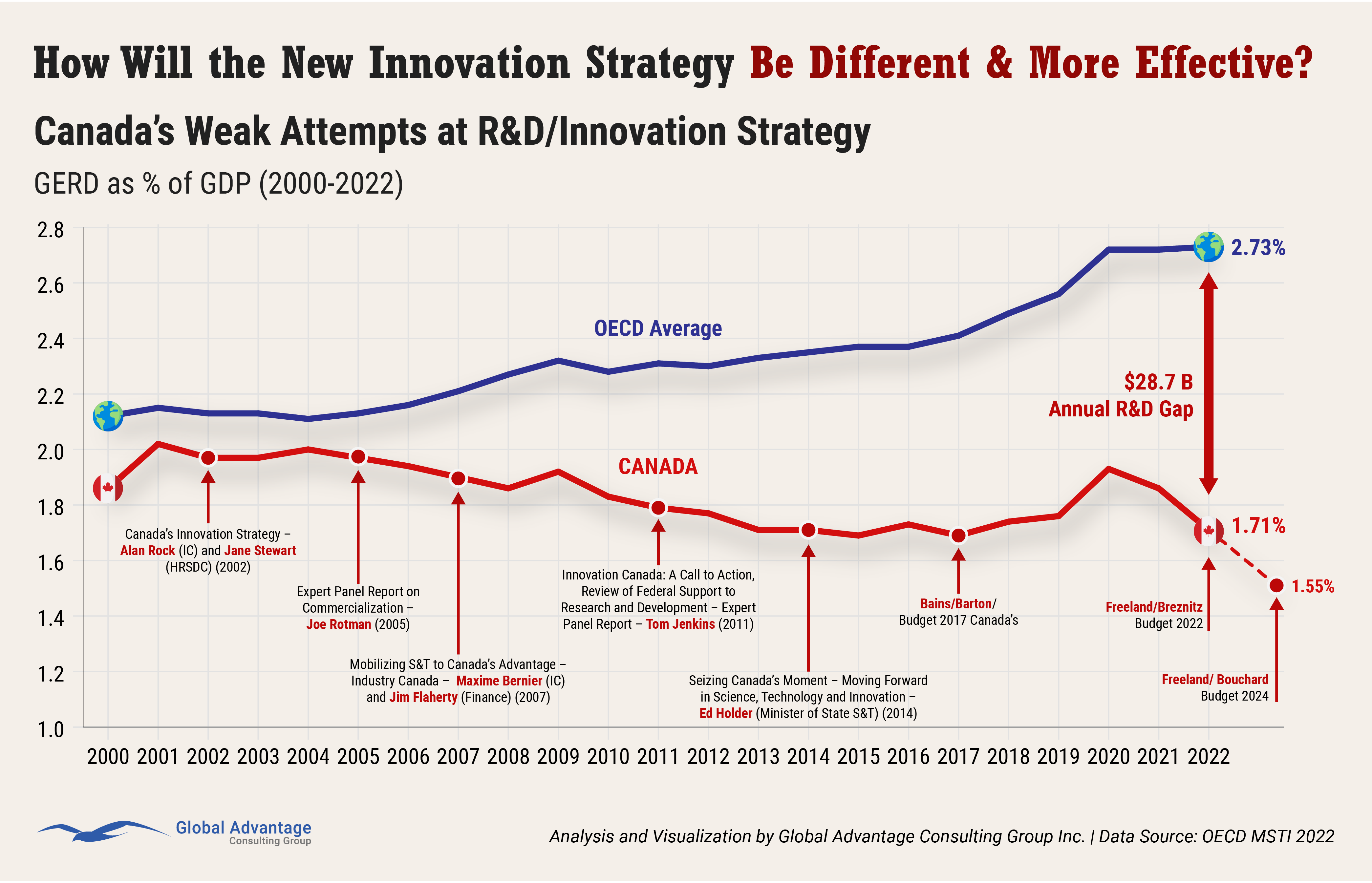

Furthermore, Canada's national R&D expenditures in 2022 were 37 percent below the average of Organisation for Economic Cooperation and Development (OECD) countries as a percentage of Gross Domestic Product, resulting in a $28.7-billion annual investment gap, according to Global Advantage Consulting Group's analysis (see graphic below).

While Canada's higher education R&D expenditures as a percentage of GDP are 40 percent above the OECD average, Canada's business R&D expenditures are 50 percent below the OECD average and government intramural R&D expenditures are 57 percent less (see graphic below).

Canada also lacks recent investments in machinery and equipment (which indicates embedded innovation) as well as investments in intangibles including intellectual property. Canada's innovation system faces challenges such as low investment, lack of competitive strategies and implementation and poor coordination.

Regulatory burden is a major barrier to innovation. According to Senator Colin Deacon’s February 2023 report, Stagnant regulations impair innovation and economic growth, Canada ranks 35th out of 38 OECD countries in managing “regulatory burden.”

Meanwhile, Europe is launching a “simplification revolution” when it comes to regulations and U.S. President Donald Trump is expected to “deregulate” the U.S. economy.

Modernizing Canada’s regulatory and procurement systems is critical to fostering innovation. Global Advantage Consulting Group’s overall assessment of Canada’s R&D/Innovation, through a detailed report card, incorporates a series of reputable indexes to position Canada’s performance, such as the Global Competitiveness, Global Talent Competitiveness, Global Innovation Index and others (see graphic below).

The need to retain and scale Canadian companies

Ownership and control of promising innovative companies are fundamental to improving Canada’s innovation ecosystem. Retaining homegrown companies and providing the necessary tools and support mechanisms to scale up within Canada must be a top priority (see for example, A Blueprint for the Canada Innovation Corporation, 2023 and Building a Nation of Innovators, 2019). This approach is about creating a policy environment that encourages firms to stay in Canada and thrive within the global economy.

In the context of scaling up, one of the most frequently cited factors is the critical role of financial capital. Many Canadian companies relocate their headquarters to the U.S. due to greater availability and ease of access to capital.

While some argue that Canada may never match U.S. investment levels, innovative financial and partnership models must be explored to address this challenge. For instance, to what extent are Canada’s pension funds investing in Canadian companies to support their growth and scale-up?

In March 2024, more than 90 top Canadian business leaders signed an open letter to the federal and provincial ministers of finance, pointing out the urgent need to address the decline in domestic investments by pension funds. The letter noted that Canadian pension funds have reduced their holdings of publicly traded Canadian companies from 28 percent of total assets in 2000 to less than four percent at the end of 2023.

Additionally, the U.S.'s recent protectionist and competitive policies, measures and incentives have created a push-and-pull dynamic influencing Canadian companies' decisions to stay or relocate.

Policies such as the Tax Cuts and Jobs Act of 2017, the Inflation Reduction Act, and the CHIPS and Science Act of 2022 have enhanced the attractiveness of the U.S. as a destination for business operations.

How can government policy make innovation and commercialization a more compelling business strategy for Canadian firms – helping them access markets and value chains, lowering the costs of capital and talent, and strengthening networking between firms and the ecosystem actors that support their growth?

These kinds of measures aimed at bolstering domestic competitiveness and innovation are expected to continue to roll out of the U.S. system under Trump’s presidency, posing challenges for Canada in retaining and growing its firms. Such measures highlight the need for a strategic framework to ensure Canadian businesses remain innovative, productive and competitive in a rapidly evolving North American and global market.

The talent shortage: Closing the skills gap

A significant challenge in Canada’s innovation ecosystem is the availability of talent that aligns with the needs of the country’s industrial sectors and service economy.

Despite having one of the world's most educated workforces, leading the Group of Seven nations with 57.5 percent of Canadians aged 25 to 64 holding a college or university degree, there remains a notable shortage of skilled professionals in key areas. To address these gaps, Canada must continue developing relevant skills domestically and scale upskilling and reskilling programs to match the growing pool of companies.

About two-thirds of researchers end up working in the private sector. Therefore, transferring higher education talent, with research knowledge and skills, to industry becomes paramount. Beyond talent development, it is crucial to enhance Canadian industry-academia collaboration to ensure knowledge is brokered and used to meet citizens’ needs.

The No. 1 challenge Canadian companies face is acquiring talent. If the domestic market cannot produce the necessary skills and competencies promptly and at scale, it is natural to look globally to attract and retain essential talent. Despite recent backlash against immigrants, research by Innovation, Science and Economic Development Canada highlights the reliance on international talent to fill some of these roles.

Steps needed to transform Canada’s innovation ecosystem

A healthy innovation ecosystem relies on collective stakeholder understanding, tracking, strategizing and acting on dozens of key factors and indicators.

While a new federal government will be formed in Canada sooner or later in 2025, the current government in Budget 2024 committed to forming a new Advisory Council on Science and Innovation, comprised of leaders from the academic, industry and not-for-profit sectors, that will be responsible for developing a new National Science and Innovation Strategy for the country.

Canada needs an increased focus on demand-side measures to balance overreliance on the supply side to improve its innovation performance. These measures include modernizing regulatory and procurement systems, and de-risking the adoption and diffusion of innovations across the Canadian industry and business landscape.

Canada should integrate the existing elements of siloed industrial strategies, plans, roadmaps, metrics and processes, while developing complementary and globally competitive new approaches to improve performance.

For Canada’s innovation ecosystem to thrive, it must operate with a global mindset and vision. This requires identifying and targeting problems and gaps in domestic and international markets, and addressing them with new and innovative products, services, processes and business models.

Canada has distinct opportunities in areas such as clean technology, health and biotech, natural resource processing and manufacturing, the adoption of new technologies (including major advancements in artificial intelligence), and the emerging field of quantum computing to develop globally competitive, unique and innovative products, services, processes and business models.

In the current global context, Canada must take a closer look at economic security and supply chain resiliency. Innovation must be a whole-of-government priority, aligning all levers in their power: spending, tax, regulations, procurement, skills, and trade programs.

The time is long overdue for Canada to rethink innovation policies and integrate the country’s programs to address the "Great Fragmentation” (which currently encompasses more than 130 programs, at the federal level alone, supporting business innovation and growth). Canada should set a national R&D/GDP target, as most industrialized nations have done (such as Finland, the EU, the U.K., and China).

Canadian policymakers, businesses and academic institutions must also urgently address the disconnect between Canada’s innovation potential and performance. This requires closing the R&D and innovation investment gap, retaining and scaling Canadian companies, addressing talent and skills shortages, and adopting a global market mindset to transform Canada's innovation ecosystem into a competitive leader.

R$

| Organizations: | Global Advantage Consulting Group |

| People: | Ömer Kaya |

| Topics: | transforming Canada's innovation ecosystem for global competitiveness |

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 1 free article remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.